Home Pricing:

Virchu Financial & Investment will get the top dollar for your house. However, it is also our responsibility to educate our Sellers with Home Prices as well: Over Pricing and home sales stagnated. Under Pricing and home sales inundated.

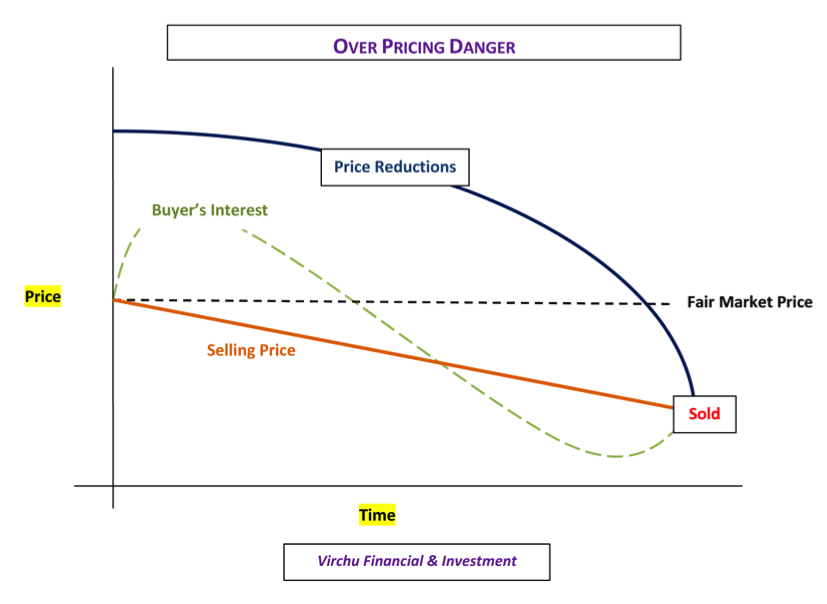

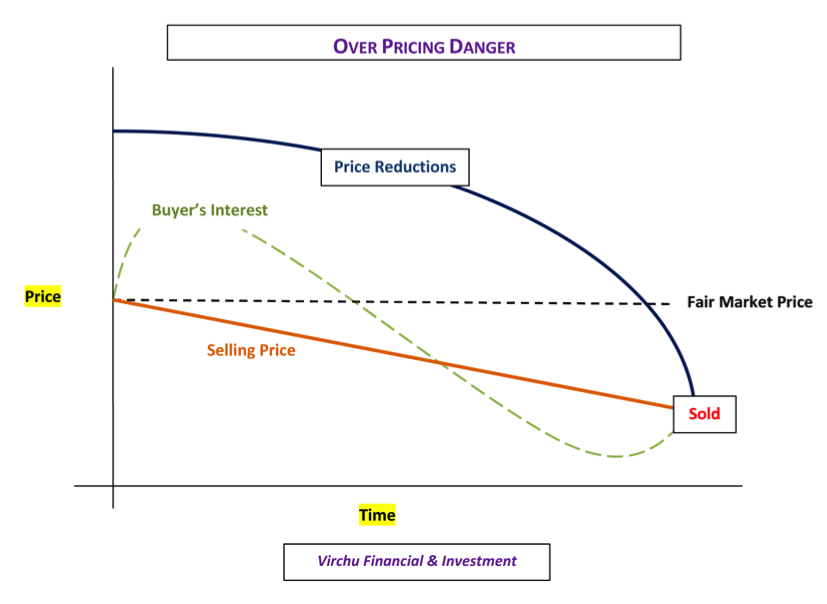

Over Pricing Danger

Over pricing a home would under value its worth: the longer a house is on the market, the more its value is depressed:

a) The longer a house is on the market, the less demand it is: It has to compete with new houses coming onto the market.

b) When demand is lessen, competition is dampened. Price is depressed.

c) Left out qualify Buyers. Buyers do buy homes with a budget. Even a $10,000-$15,000 over price will nudge many qualified Buyers.

d) When sellers over price their houses, the market will perceive sellers are not serious Sellers.

e) Financing will be an issue for most Buyers, because Down Payments, Loan to Value, Appraisal, Loan Approval, and Closing will be problematic.

f) It discourages immediate interested Buyers. Serious Buyers will not wait around for price reduction, offer, counter, and counter offers.

g) The fact of the matter is—it doesn’t matter how many Real Estate Professionals list an overpriced house, it doesn’t change the fact that an over price house is not selling.

Perceptions matters. The longer a house is on the market, the more likely it will sell for lower. Time is important. Time on the market does affect price and value. If you are looking to sell your home the right way with excitement, enthusiasm, and for the most money on the market—at Virchu Financial & Investment, we deliver!

Pricing Low: Few home Sellers underpriced their homes, but it does happen. Home owners believe under pricing their home by a lot creates a bidding war among Buyers. This is true. A frenzy bidding war will ensue. Not until Sellers receive over 10 similar purchase offer price from 10 different Buyers, then Sellers will realize that under pricing their homes does not make it worth any more.

The fact is homes can only be sold for as much as the last similar sold homes. More likely than not, current selling price will almost always revert back to the market value price: price and value of homes are determined by the previous sold home.